How Technology Is Driving Social Finance Innovation (Citigroup)

Across the globe, new technologies are driving unprecedented positive impact on segments of the population that have historically lacked access to basic social and economic services.

New and innovative business models are emerging with the promise of generating inclusive economic growth. From Bangalore to Nairobi to Mexico City, Citi’s clients are at the forefront of digital advancements that are driving this growth. As part of Citi’s Institutional Clients Group (ICG) Innovation week, I had the honor of leading a dynamic discussion with some socially-driven companies that are using technology to build scalable solutions.

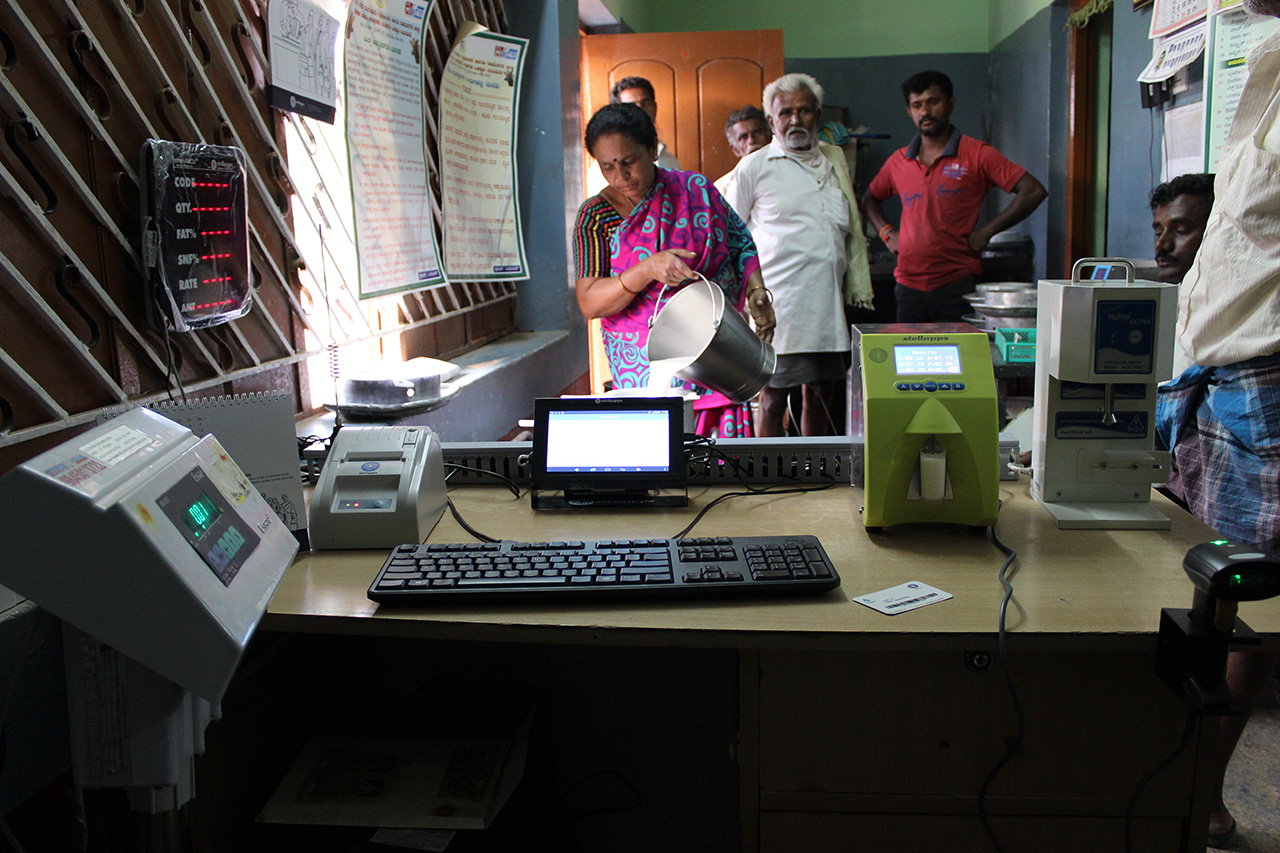

In India, the world’s largest milk producer, where an estimated 80 million people are involved in the dairy industry, the supply chain is extremely fragmented. Most dairy farmers own just two to three cows and make only 60 cents per day. StellApps, a Citi India client, offers a range of solutions to digitize the supply chain and increase farmer incomes. The company provides electronic sensors to boost diary production, digital cloud and routing systems for real-time grading and pricing, animal facial recognition to support insurance identification and claims, and even offers QR codes for fast-moving consumer goods companies providing the diary in markets. These technologies resolve key pain points in dairy production and enable Stellapps to use supply chain data to underwrite credit through an innovative scoring mechanism and expand access to working capital for smallholder farmers. Thorough this intervention, StellApps calculates that farmers’ income can increase at least tenfold, giving them the possibility to purchase more cows and expand their businesses.

Across Africa, millions of households still rely on kerosene for lighting, which is a fire hazard and can cause impaired lung function, asthma, cancer and increased susceptibility to infectious diseases such as tuberculosis. d.light combines solar power with mobile payments and small dollar loans to make access to electricity accessible and affordable to their clients on a pay-as-you-go basis. So far, the company has helped 100 million households and small businesses living off the grid to replace kerosene with cleaner sources of electricity. For d.light, off-grid solar is a starting point on the energy access ladder. Looking at the next decade, they seek to transform the lives of people who are still without electricity by expanding access to information and increasing quality of life through transformational products like smart phones, radios, news, and air conditioners – and with the potential of improving livelihoods and creating income-generating opportunities for their clients.

In Mexico, four in five small and micro-enterprises (SMEs) use personal credit cards for their business, often paying over 50-60% interest or even more expensive sources of funding. Konfio Mexico, a leading fintech company and Citibanamex client, is helping these businesses change the way they operate by providing digital tools, funding and working capital. Konfio uses data to expand access to affordable finance, and to date, has provided loans to over 20,000 SMEs. They also track SME performance and productivity, providing essential business operations feedback to help their clients grow. Through a combination of financing and guidance, Konfio has boosted client growth by 28% year over year.

All of these companies have made major progress and have set ambitious goals for the future. Stellapps aims to multiply their base by five within three years. d.light seeks to reach the one billion people globally who still do not have access to energy. Konfio plans to grow with their partners, creating new and more complex solutions to meet their growing client needs.

How will these companies continue to scale? The answer is simple: digital innovation.

At Citi Inclusive Finance, we work with Citi businesses in over 50 countries to bank, partner with, and provide access to funding to clients that are offering services to low-income, historically underserved segments of the population. Since inception, Citi Inclusive Finance has mobilized over $4 billion in funding to finance and scale inclusive portfolios of our clients around the world.