UK Retail's Toughest Period - Where Has Been Hit Hardest? (CBRE)

Retail is in the midst of arguably its toughest ever period, but which parts of the UK have been hit hardest?

Recent figures from the Local Data Company (LDC) show that the number of retail units in the UK has fallen by 7% between 2015 and July 2020, equating to 32,500 stores. This reflects the structural shifts, such as the growth in online retail, which have brought about change in the retail industry over the last few years. These changes have then been accelerated due to the COVID 19 crisis.

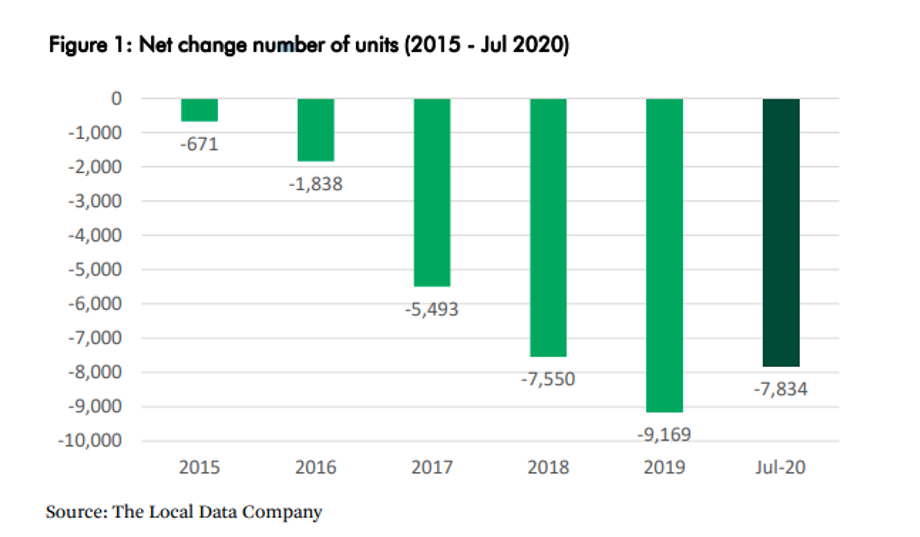

While the last few years have been highly challenging for retail, it is clear that 2020 will be on a completely different level. The first half of the year has resulted in a net loss (more closures than openings) of 7,834 retail units, worse than every full year prior other than 2019 ( 9,169). The chart below shows a clearly worsening pattern, and the second half of 2020 is expected to see similar results. However, this does present significant opportunities for astute landlords to redevelop and repurpose vacant units.

Figure 1: Net change number of units (2015 - Jul 2020)

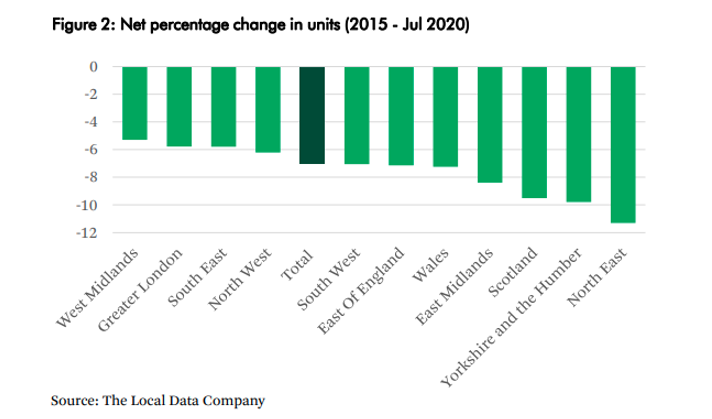

NORTHERN REGIONS SEE THE GREATEST FALL IN RETAIL UNITS

There is a clear north-south divide in terms of how these falls have been spread across the UK, with the north suffering far worse than the south. Looking across the period from 2015 to July 2020, the northern regions (inc. Scotland) of the UK have seen a net loss of -10.2% of total retail units. This is compared to -7% for the midlands and Wales combined, and -6.2% in the south.

This is part of a wider trend of inequality across the UK, with the economic situation in the north far worse than the south, leaving the former more exposed for when crises such as this hit. For example, official government data from 2018 found that disposable income in the north east was £17,000 per head, compared to £29,000 in London1 . These inequalities are currently being exacerbated by the second wave of COVID-19 where the north of England seems to be faring worse than the south. CBRE highlighted how this was putting greater pressure on retail in the north in our Retail Resilience report.

NO V-SHAPED RECOVERY FOR RETAIL

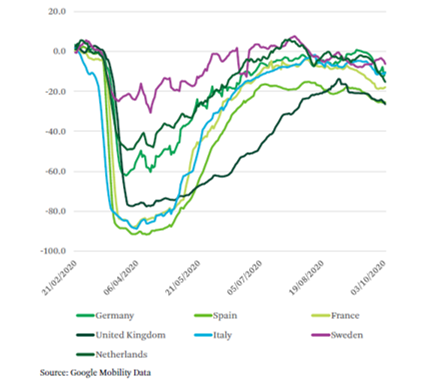

Google Mobility data for footfall at different location types (see chart below) shows that the UK still lags behind all other European countries – where data is available – in terms of Retail & Recreational traffic compared to pre-Covid. The UK is down more than 26% on pre-Covid levels, slightly worse than Spain (-25%), but far below Sweden (-6.3%) and Germany (-10.3). With the UK now experiencing a dramatic increase in Covid-19 cases, we expect to see further substantial falls in footfall.

Figure 3: Google Mobility rolling 7-day average - retail & recreation

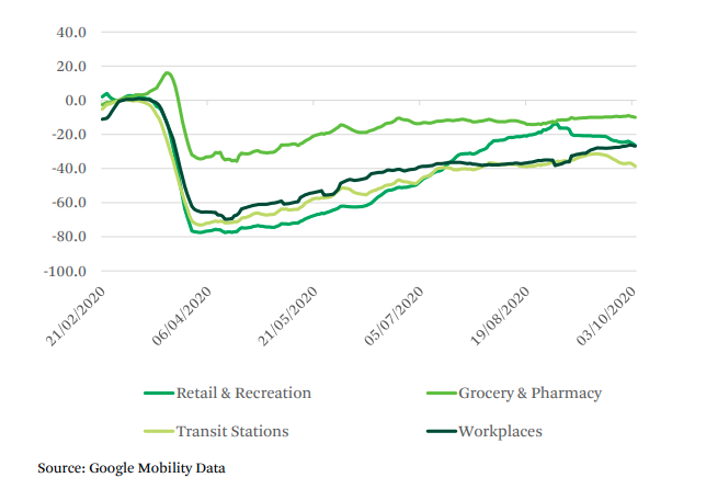

This will continue to reverse some of the positive movements seen over the summer months, driven by the Eat Out to Help Out scheme. The drop off had already begun once the scheme ended and weather conditions worsened, but any further Covid induced lockdowns may be the final straw for some retailers. Ignoring the pending doom of potential further lockdowns, the key longer term factor for city centre retail, particularly in Central London, is when and how often people start going back to work in the office.

Figure 4: Google Mobility 7-day moving average - UK

LONG TERM FUNDAMENTALS WILL BE KEY FOR CENTRAL LONDON

Central London retail is under the most pressure. Footfall remains more than 50% down on pre-Covid levels in most key locations, and further restrictions now being brought in to combat rising Covid-19 cases will put a huge dent in the recovery effort. Despite these negative factors, we still believe in the long-term fundamentals that have underpinned the capital and made it one of the most popular destinations in the world. London has a young, international, highly skilled workforce; tourism will return, and it will continue to be a hub for financial but also creative and digital industries.

WHAT DOES THE FUTURE HOLD FOR UK RETAIL?

For some retailers it will simply be a case of survival for the next 12-18 months. For those who can, the survival factor will be the ability to use this period of crisis to reassess what the long-term goals of a shop or a destination are. There will be more pain to come, and it probably won’t be felt evenly across the country with the north looking more exposed due to its less resilient economic fundamentals. However, when the ‘new normal’ eventually arrives, those retailers who have survived will have access to a bigger slice of the consumer spending pie than before.